Managers’ big concern is related to that definition of an asset. Second, because of the failure to carefully and systematically document investment in human capital, there is little evidence that these investments pay off. This separation of capital from labor also creates frustrations for socially responsible investors who want to reward companies for taking steps to tackle income inequality through workforce retraining, or straight fiduciary asset managers whose thesis is that workplace training will lead firms to outperform their peers. Mark Warner of Virginia summed up this inadequacy during a recent speech, when he pointed out that government “provides a tax deduction to the company that replaces a human with a robot, but offers nothing to the company that trains that worker to remain employable.” Elected leaders who want to improve economies through increased employment are no longer guaranteed the result they desire when dangling tax breaks for private investment.

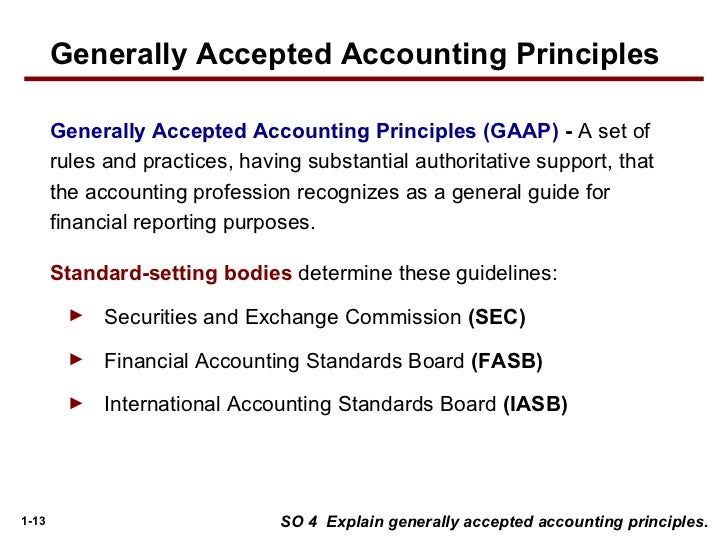

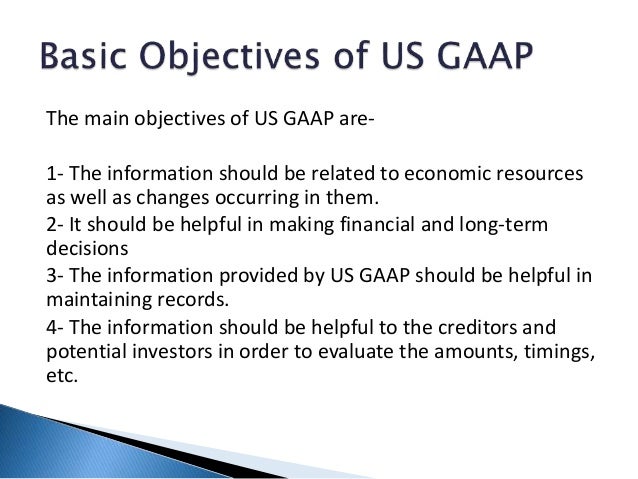

First, what is not measured cannot be rewarded. This lack of reporting on human capital discourages effective investment in workers for at least two reasons. The economy has grown in ways that leave the current rules behind, and that is having negative consequences for the employees of these companies. But automation and a move away from manufacturing have created a disconnect between physical capital and the need for labor. The costs and benefits of a machine are easier to estimate than the costs and benefits of training those employees, so the machine went on the balance sheet, and the employees’ costs were expensed as incurred. There was a time when this practice made sense: Manufacturing was labor intensive, so opening a new plant or buying a new machine required the hiring of employees to run that machine. Companies report detailed information about their capital investments but have almost no reporting requirements related to human capital. Generally Accepted Accounting Principles (GAAP) is an outdated and inadequate tool for documenting the behaviors of the modern corporation. We need a new way to account for labor so that we can track and reward companies for how they actually treat their employees. Right now, there’s no universally accepted way to track the management of human capital. The current lack of disclosure related to employment practices prevents policy makers and investors from rewarding or punishing companies for how they actually treat their employees. The distinction matters because it allows companies to hide behind platitudes and not disclose whether they invest in their workers in ways that promote long-term success. Workers must convert raw materials – be they commodities or blank computer screens – into finished inventory to be paid, but if these workers want to quit, they can take their skills and training with them. By definition, employees are not assets since companies do not have control over them. You hear it all the time: companies touting employees as “their most valuable assets.” But under current accounting standards, that is simply false. Lastly, companies should report their investment in training just like they do their investment in capital. It could also offer a sense of the culture within the company, encouraging firms to take steps to ensure that workers stay. Providing information related to the average length of tenure would be insightful given that hiring is so costly. Specifically, much like banks already do, all companies could report the total wage bill of the firm. Companies should provide concrete information.

By definition, employees are not assets since companies do not have control over them. The distinction matters because it allows companies to hide behind platitudes and not disclose whether they invest in their workers in ways that promote long-term success.

0 kommentar(er)

0 kommentar(er)